Fifteen percent improved or expanded facilities and 6% acquired new buildings or land for expansion. Of those making expenditures, 40% reported spending on new equipment, 23% acquired vehicles, and 11% spent money for new fixtures and furniture. Labor quality remains in second place behind inflation by one point as the top business problem.įifty-seven percent of owners reported capital outlays in the next six months, down three points from February.

Eleven percent of owners cited labor costs as their top business problem and 23% said that labor quality was their top business problem.

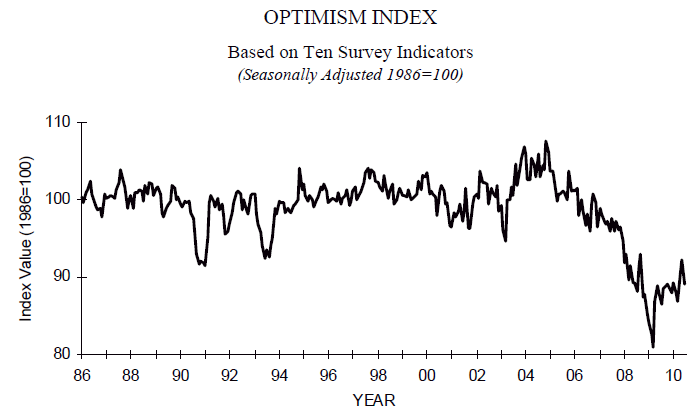

Twenty-six percent of owners reported few qualified applicants for their open positions and 27% reported none. – The net percent of owners who expect real sales to be higher deteriorated six points from February to a net negative 15%.Īs reported in NFIB’s monthly jobs report, a seasonally adjusted net 15% of owners are planning to create new jobs in the next three months. – The net percent of owners raising average selling prices decreased one point to a net 37% seasonally adjusted. – Forty-three percent of owners reported job openings that were hard to fill, down four points from February and remaining historically very high. “Hiring plans fell to their lowest level since May 2020, but strong consumer spending has kept Main Street alive and supported strong labor demand.” “Small business owners are cynical about future economic conditions,” said NFIB Chief Economist Bill Dunkelberg. Small business owners expecting better business conditions over the next six months remain at a net negative 47%. Twenty-four percent of owners reported inflation as their single most important business problem, down four points from last month. Small Business Optimism Index decreased 0.8 points in March to 90.1, marking the 15th consecutive month below the 49-year average of 98.

0 kommentar(er)

0 kommentar(er)